AI Marketing Scams: A Cautionary Guide for Businesses and Agencies

Image courtesy of The Drum

AI-washing refers to the practice of labeling products or services as "AI-powered" without any substantial enhancements provided by artificial intelligence. This often leads to over-promises and underwhelming results. Companies and agencies may use terms like “AI-driven frameworks” without offering clarity on how they work or the specific AI components involved. Notably, AI-washing may damage credibility, causing clients to hesitate in exploring genuinely useful AI innovations later.

For deeper insights on AI guidelines, refer to the article on well-crafted AI guidelines.

Recognizing Red Flags

Identifying AI-washing can be straightforward if you know the red flags. Look out for grand claims without backing, vague explanations, and a lack of transparency regarding data privacy. If the marketing sounds impressive but lacks concrete details about AI's role, it's likely just gloss. Questions to ask include:

What part of this is actually AI, and how does it work?

Are there guardrails or reviews involved in the process?

Does this tool save time or improve quality in a meaningful way?

If you find the responses vague or contradictory, it may be wise to move on.

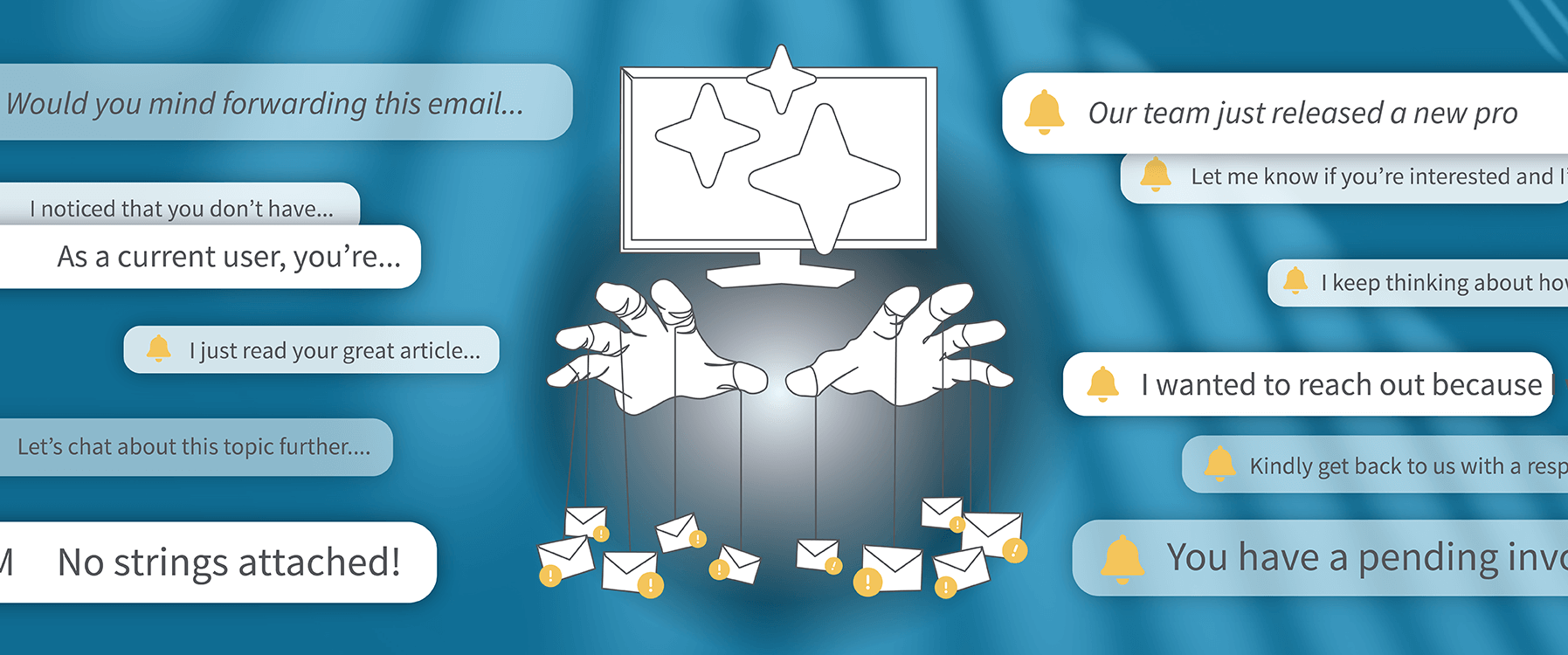

AI Marketing Scams

Image courtesy of Tenato

AI marketing scams are becoming increasingly sophisticated, employing AI to create convincing solicitations. These scams may appear legitimate, leveraging data from social media or websites to craft personalized messages. For example, a recent scam involved an email that seemed to confirm a service order, complete with a chain of correspondence, making it difficult to spot as spam.

Businesses need to remain vigilant. Marketing agencies are tempted to use AI for everything, from content generation to marketing research, which raises concerns about the legitimacy of solicitations. The risk lies in the perception that if AI can perform these tasks, businesses might question the necessity of hiring marketing agencies at all.

Handling Solicitations

When receiving unsolicited calls or emails, it’s essential to treat them with skepticism. A recommended practice is to avoid providing personal data over the phone, as this approach helps mitigate risks. Establish clear protocols for accounts payable staff, ensuring they recognize only verified vendors.

Assuming solicitations are scams until proven otherwise can protect against financial losses. If possible, arrange meetings in person or via video conferencing to verify identities before proceeding with any business arrangements.

AI in Fraud Detection

The use of AI in banks and financial institutions is rapidly evolving, with technology enabling them to detect fraudulent transactions more swiftly and accurately than human capabilities. AI analyzes vast amounts of data to identify patterns indicative of fraud, helping to prevent financial crimes before they escalate.

In one notable case from December 2024, deepfake technology was utilized in a scam that led to the loss of $US25.6 million. Fraudsters impersonated executives during a video conference, convincing an employee to transfer funds, demonstrating the danger posed by advanced AI technologies in the wrong hands.

Banks are now leveraging these AI tools to stay ahead of increasingly sophisticated cybercriminals, ensuring they can act on real-time information and mitigate potential fraud risks.