Introduction

You've just built the next game-changing cybersecurity tool. You know it's brilliant. Your beta users are raving about it. But when you walk into that first VC meeting, you might as well be speaking Klingon.

Because here's the thing about cybersecurity funding – it's weird. Really weird.

Most VCs will nod along when you mention "zero-trust architecture" or "behavioral analytics," but honestly? Half of them are just hoping you'll get to the revenue projections soon. They don't get why your threat detection engine is fundamentally different from the fifty other ones they saw this month.

But then there are the others. The VCs who actually understand that cybersecurity isn't just another SaaS vertical. Who knows why timing matters when a new vulnerability drops. Who get that your go-to-market strategy can't look like a typical B2B playbook because, well, nobody wants to admit they got hacked.

These are the investors who don't just write checks – they become your strategic partners. They've seen this movie before (probably funded it, too).

So yeah, this isn't just another VC directory. It's your cheat sheet for finding the investors who actually speak your language. The ones who won't ask you to "dumb down" your technology or question why enterprise sales cycles take forever.

Because in cybersecurity, having the wrong investor isn't just frustrating – it can actually slow you down when speed is everything.

Why Cybersecurity Startups Need Venture Capital

Building a cybersecurity startup without funding is like trying to architect zero-trust without infrastructure—it just doesn't scale. Great ideas are essential, but execution is what wins. And in cybersecurity, execution requires capital.

Here's why venture funding is critical:

- Top-Tier Talent: Security engineers, threat analysts, and compliance experts don't come cheap—and they shouldn't.

- Scalable Infrastructure: From secure cloud environments to regulatory compliance (GDPR, HIPAA, SOC 2), the technical foundation needs to be solid from day one.

- Enterprise Validation: Landing that first enterprise client takes more than a pitch deck. You need credibility, pilots, and proof of value. Venture capital (VC) isn't just about money. Investors are backing startups with real potential—those that can fix today's problems and stay ahead of future threats.

What Cybersecurity VCs Look For in 2026 (Not 2019)

It's not about vanity metrics anymore. Here's what investors who get cybersecurity are paying attention to:

- Tech that's hard to copy — Not just another DevSecOps layer with a new UI.

- Founders who've been in the trenches — Ex-intel, CISO, red team, blue team... real-world experience counts.

- A real problem, not buzzwords — Slapping “AI” on access control isn't enough.

- You can sell to enterprises — If you're aiming for $50K+ deals, they want to see that you know how to close.

- You're building for what's next — Post-quantum, AI-native, OT/ICS security... Those areas are getting real attention.

If your pitch feels like “yet another SOAR platform,” don't be shocked if no one calls back.

Top 25+ Cybersecurity Venture Capital Firms in 2026

We've done the research and put together a list of the top 25+ VC firms that truly understand cybersecurity. These investors aren't just betting on trends — they're partnering with founders who are building real solutions for real threats.

| Firm Name | Headquarter | Category | Focus | Notable Investment |

|---|---|---|---|---|

| Accel | Palo Alto, CA | General Tech VC | Early to growth-stage investments in cybersecurity and tech | CrowdStrike and Sumo Logic |

| AllegisCyber Capital | Palo Alto, CA | Cybersecurity-Focused VC | Cyber-focused venture firm | Workday, Cisco, VMware, and Dragos |

| Ballistic Ventures | San Mateo, California | Cybersecurity-Focused VC | Funding and incubating cybersecurity innovations | Perygee, Hello Soju, Nudge security, and Cado Security |

| Evolution Equity Partners | New York, NY | Cybersecurity-Focused VC | International venture capital investor in cybersecurity and enterprise software | AVG Technologies, Cognitive security, Open DNS and Security Scorecard |

| Greylock | Menlo Park, California | General Tech VC | Early-stage investments, helping entrepreneurs build valuable companies | Airbnb, Coinbase, Facebook and LinkedIn |

| Insight Partners | New York, NY | General Tech VC & Growth Equity | Growth-stage investments across various tech sectors, including cybersecurity | Shopify, Docusign, and Databricks |

| Lightspeed Ventures | Menlo Park, California | General Tech VC | Seed to growth-stage investments in enterprise, fintech, and cybersecurity | Rubrik, Snap Inc., Guardant Health, and Nicira |

| NightDragon | San Francisco, CA | Cybersecurity- Focused VC | Closing the gap between offense and defense in cybersecurity | RapidSOS, Onapsis, Capella Space and Rhombus |

| Paladin Capital Group | Washington, D.C., USA | cybersecurity and national security VC | Venture investment in cybersecurity and national security | Corellium, Cyberhedge & DPOrganizer |

| Sequoia Capital | Menlo Park, California, USA | General Tech VC | Early to growth-stage investments in cybersecurity and other tech sectors | Apple, ByteDance, Cisco, DoorDash, Dropbox, Nubank, and Zoom |

| SYN Ventures | West Palm Beach, Florida, United States | Cybersecurity- Focused VC | Disruptive, transformational solutions in cybersecurity | Adlumin, Halcyon, Phosphorus, and Talon Cybersecurity, SquareX and BforeAI |

| Team8 | Tel Aviv, Israel | Cybersecurity-Focused VC & Venture Builder | Building technology companies with a focus on cybersecurity | Draftkings, Slack and Opendoor |

| Ten Eleven Ventures | Arlington, Virginia, USA | Exclusive Cyber VC | Cyber-focused counsel, capital, and connections for security entrepreneurs | six unicorns and 21 acquisitions |

| YL Ventures | Herzliya, Israel | Exclusive Cyber VC | Exclusive focus on cybersecurity, from seed to lead | Orca Security, Axonius, and Vulcan Cyber |

| Qualcomm Ventures | San Diego, California, USA | Corporate VC | Growth-stage investments in the wireless ecosystem, including cybersecurity | Jio Platforms, Echo3D, and Zuddl |

| Bessemer Venture Partners | Redwood City, California, USA | General Tech VC | Seed and Series A investments in cybersecurity and other tech sectors | BigBasket, Urban Company, Swiggy, Perfios, and Livspace |

| Andreessen Horowitz (a16z) | Menlo Park, California, USA | General Tech VC | Early to growth-stage investments in cybersecurity and other tech sectors | Facebook, Airbnb, and Coinbase |

| Blu Venture Investors | Vienna, Virginia, USA | Exclusive Cyber VC | Early-stage investments in cybersecurity, healthtech, and B2B SaaS | ID.me, Huntress, Immuta, and NS8 |

| Secure Octane | San Francisco, California, USA | Exclusive Cyber VC | Early-stage investments in cybersecurity, data platforms, and enterprise infrastructure | KeyNexus, Kibsi, CyberGRX, ProcessUnity, and Zenduty |

| Khosla Ventures | Menlo Park, California, USA | General Tech VC | Early-stage investments across various tech sectors, including cybersecurity | OpenAI, DoorDash, Instacart, Block (Square), Affirm, and Okta |

| Intel Capital | Santa Clara, California | General Tech VC | Investments in cybersecurity and other tech sectors | Orchid Security, SecurityScorecard |

| Sapphire Ventures | Menlo Park, California | Growth-Stage Enterprise Tech VC | Investments in cybersecurity and other tech sectors | Restream, Punchh, DocuSign, Nutanix, and Monday.com |

| Twilio Ventures | San Francisco, California, USA | Corporate VC | Early-stage investments in cybersecurity and communication services | Frame AI, Calixa, Hyro, Mux, Algolia |

| Acrew Capital | Palo Alto, California, USA | General Tech VC | Early and growth-stage investments in cybersecurity and other tech sectors | LearnVest, OneMedical, Rothy's, Sofi, Stubhub, Upstart and Yodlee |

| Index Ventures | London, UK | General Tech VC | Global early- and growth-stage investments across SaaS, cybersecurity, AI, and consumer technology. | Wiz |

| Runtime Ventures | Arlington, Virginia, USA | Exclusive Cyber VC | Early-stage investments in developer tools, cloud infrastructure, and enterprise software innovation. | Duo Security, Enveedo |

| Glilot Capital Partners | Herzliya, Israel | Exclusive Cyber VC | Early-stage investments in cybersecurity, enterprise software, and AI-driven technologies. | Lightspin |

| Shasta Ventures | Menlo Park, California, USA | General Tech VC | Early-stage investments in cybersecurity, smart software, and digital tech. | Cybereason |

How to Pick the Right VC (Without Wasting 6 Months)

Not every investor who's cutting cyber checks deserves a spot on your cap table. Ask yourself:

- Have they actually backed security startups? If not, be ready to explain what MFA is... over and over.

- Can they intro you to CISOs? Warm intros to the right buyers are worth more than the money.

- Do they invest at your stage? Don't waste time pitching seed to a Series C-only firm.

- Can they fill your biggest gaps? Whether that's GTM, hiring, or navigating compliance hell.

Pro tip: Look for VCs who write or speak about cyber. If they've never said a single public word on security, chances are they don't get it.

Founder Red Flags: What to Watch For in VCs

- “We're generalists but super into cyber right now.” → Translation: just chasing the hype.

- “We can help you sell to enterprise.” → Cool. Ask them to intro you to 2 CISOs this month.

- No follow-on support → Are they still around when things get bumpy?

- Exit pressure → Cyber isn't always a quick exit game. If they're impatient, that's a problem.

- Weird portfolio vibes → Talk to their founders. Are they helpful… or just hovering?

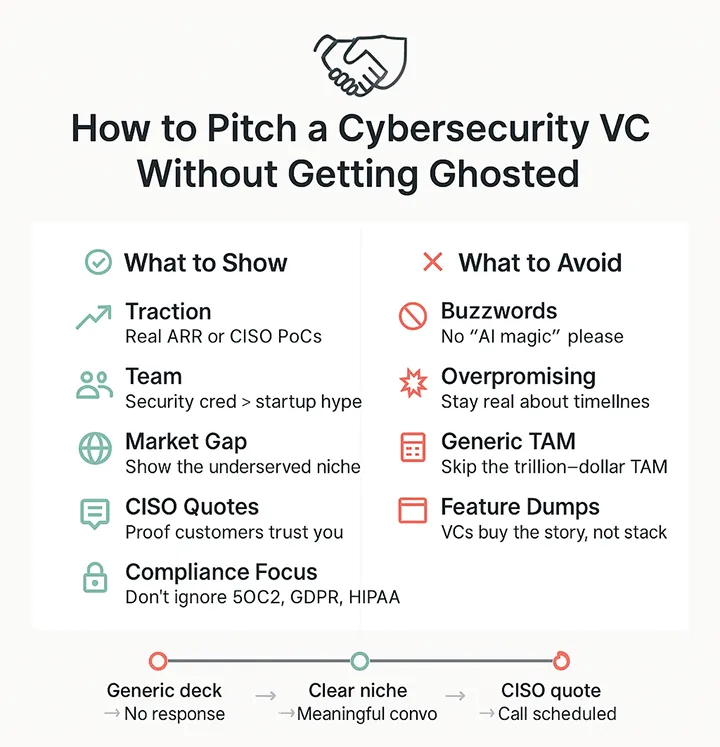

How to Pitch a Cybersecurity VC Without Getting Ghosted

Pitching to a cybersecurity-focused VC is not just about selling a product—it's about showing that you deeply understand the threat landscape, the buyer mindset, and the market's real pain points. Here's a practical framework to help you get taken seriously:

Lead with What Matters

1. Traction That Proves Demand

Show real progress. Customer adoption, revenue growth, proof-of-concepts with recognizable names—these signals matter more than promises.

2. The Right Team for This Problem

Cybersecurity is a credibility-driven industry. VCs want to know why your team is uniquely qualified. Prior experience in the field, technical depth, and past wins matter.

3. Market Insight with Context

Make it clear that you're not just building a product—you're solving a specific gap in a growing market.

Example: “The $4B MSSP market underserves mid-market orgs with limited in-house talent. That's where we come in.”

What to Avoid

- Buzzwords: Steer clear of vague terms like “AI for good” or overly broad TAM (Total Addressable Market) slides. Focus on concrete data and specific use cases.

- Overpromising: Be realistic about your capabilities and timelines. Avoid making claims that you can't back up with evidence.

What Actually Hooks VCs

A: Clear Differentiator

What makes your solution meaningfully better—not 10% faster or cheaper, but different in a way that matters? Example: “We're the only real-time threat detection system purpose-built for industrial IoT networks.”

B: Social Proof That Matters

If your customers trust you, make it clear. Sharing real quotes, success stories, or renewal stats is more convincing than market size claims.

From the Founders Who've Been There

Founder Experience

“We pitched 18 firms before realizing we weren't being clear. Once we focused on the real problem we're solving—and exactly who we're solving it for—conversations changed.”

From a VC Pitch Teardown

“The strongest decks weren't overloaded with features. They told a clear story: the problem, the shift in the market, why the founders are the right ones to solve it, and what early signals prove traction.”

What I Wish I Knew Before My First Cybersecurity Raise

Here are some valuable lessons from founders who have been through the fundraising process:

Picking Between Generalist and Specialist VCs

- Founder Quote: “I initially thought generalist VCs would be a better fit, but I quickly realized that specialist VCs brought a deeper understanding of the cybersecurity landscape. They were able to provide more targeted advice and connections.”

Mistakes in Term Sheets

- Founder Quote: “One of the biggest mistakes I made was not paying attention to the IP ownership clause in the term sheet. It's crucial to ensure that your intellectual property remains yours and that you're not inadvertently giving it away.”

Underestimated Costs

- Founder Quote: “I severely underestimated the costs of SOC2 compliance and the length of our sales cycles. Make sure to factor in these hidden costs when planning your budget.”

Global Cyber VC Map

Cybersecurity investment is a global phenomenon, with several non-U.S. hotspots emerging as key players. Here are some of the top regions to watch:

Europe

- 33N Ventures – Europe-wide

- Focus: B2B Cybersecurity and infrastructure software.

- Notable: Recently secured additional investment from the European Investment Fund to bolster cybersecurity investments.

- Adara Ventures – Spain

- Focus: Deep tech sectors including cybersecurity, data, and DevOps.

- Notable: Targets European teams tackling global opportunities, with a focus on pre-seed to Series A stages.

- Amadeus Capital Partners – United Kingdom

- Focus: AI, machine learning, and cybersecurity.

- Notable: Over 20 years of experience investing in innovative ventures, with a recent €80M APEX Technology Fund.

Israel

- YL Ventures – Tel Aviv

- Focus: Israeli cybersecurity startups from seed to lead.

- Notable: Exclusive focus on cybersecurity with a strong track record of supporting early-stage companies.

- Team8 – Tel Aviv

- Focus: Cybersecurity, data infrastructure, fintech, and AI.

- Notable: Raised $500 million to invest in startups, bringing total funds under management to over $1 billion.

- Glilot Capital Partners – Israel

- Focus: Cybersecurity and enterprise software.

- Notable: Recognized as the world's first VC firm focusing on cybersecurity, with a global network aiding companies in market entry and growth.

Singapore

1: Antler

- Focus: Early-stage investments across various sectors, including cybersecurity.

- Notable: Recognized by pitchbook as the most active seed-stage VC firm globally in 2023, with 262 deals.

- Focus: Early-stage tech startups in Southeast Asia, encompassing sectors like fintech, healthtech, and digital security.

- Notable: Manages assets over $250 million, with investments in over 170 companies, including several unicorns.

- Focus: Seed-stage investments in B2B enterprise and deep tech sectors, including cybersecurity.

- Notable: Invests in early-stage companies across Southeast Asia, providing hands-on support.

4. SGInnovate

- Focus: Deep tech startups, with investments in areas like cybersecurity, AI, and biotech.

- Notable: Government-owned entity that co-invests in startups alongside private investors.

United Kingdom

- Osney Capital – United Kingdom

- Focus: Early-stage cybersecurity companies.

- Notable: Launched the UK's first VC fund specializing in early-stage cybersecurity, raising over £50 million with support from the British Business Bank.

- Alicorn Venture Partners – London

- Focus: Enterprise software, AI/ML, cybersecurity, and deep tech.

- Notable: Specializes in secondary investments and acquisitions of stakes in high-tech companies across Europe.

Japan

- DNX Ventures – Tokyo

- Focus: Seed and Series A startups in cybersecurity, SaaS/cloud, and deep tech.

- Notable: Connects innovative markets by supporting founders in both the US and Japan.

- Global Brain

- Focus: Deep tech, cybersecurity, AI, robotics, enterprise software.

- Notable: Active in global co-investments; partnered with large corporates (e.g., KDDI, Panasonic).

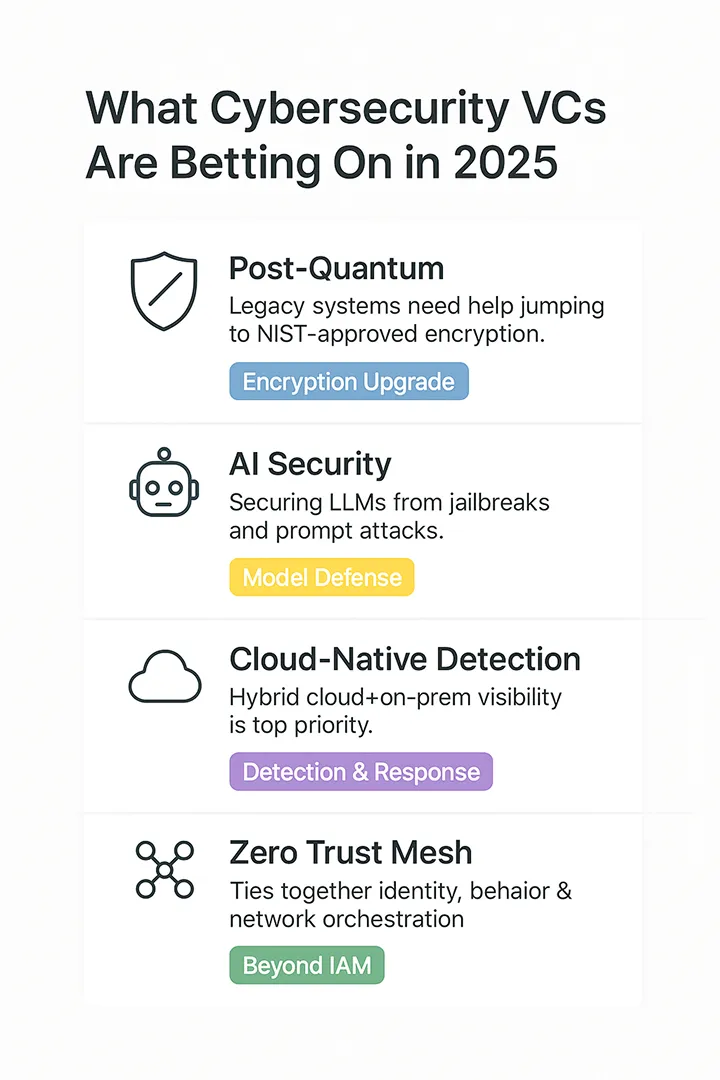

What Cybersecurity VCs Are Actually Betting On This Year

Here are some of the key trends that cybersecurity VCs are focusing on in 2026:

Post-quantum Encryption

- Trend: With NIST standards out, legacy systems need help making the leap. VCs are looking for startups that can bridge the gap between current encryption methods and post-quantum solutions.

AI Security

- Trend: Think jailbreak detection, prompt injection defense, hallucination guardrails. VCs are interested in startups that can secure AI models and prevent adversarial attacks.

Cloud-native Detection & Response

- Trend: Especially for hybrid (cloud + on-prem) setups. Startups that can provide seamless security across different environments are in high demand.

Zero-trust Mesh Orchestration

- Trend: Not just IAM—tying in network, device, and behavior. VCs are looking for comprehensive solutions that go beyond traditional identity and access management.

DevEx Security

- Trend: Securing dev environments is getting real attention. Startups that can protect development pipelines and ensure secure coding practices are attracting significant interest.

Final Thoughts

In the fast-paced world of cybersecurity, startups need more than just innovative ideas—they need the right support to turn those ideas into scalable, impactful solutions. This guide has provided a comprehensive overview of the top cybersecurity venture capital firms, what they look for in startups, and how to effectively pitch your idea to secure funding.